percent change in working capital formula

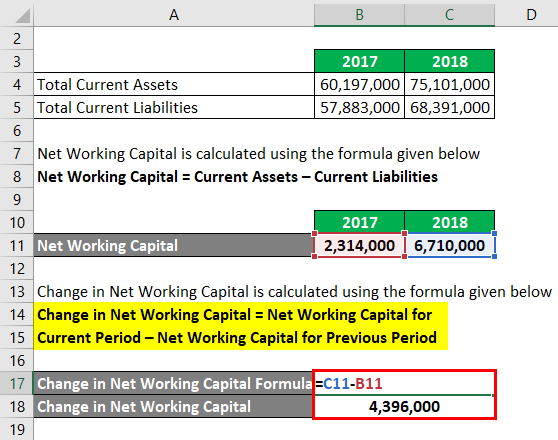

As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year. The formula to calculate the change in net working capital is.

Net Working Capital Formula Calculator Excel Template

Formula The working capital ratio is calculated by dividing current assets by current liabilities.

. I have calculated the working capital of various companies using this formula. Percentage Change New Value Original Value Original Value 100. We should also look at what percent of revenue is the working capital.

Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. The formula to calculate changes in net working capital is Working Capital of current year Less Working Capital of Last Year. The second is to base our changes on non-cash working capital as a percent of revenues in the most recent year and expected revenue growth in future years.

Subtract the previous years working capital from the current years working capital according to the calculations made above in the table. 240000 2022 105000 2021 135000. Percentage of Sales Method Example.

Decimal decrease initial value Multiply the decimal you receive by 100 to get a percentage. Consider the following balance sheet for the year 2014 as an example. Working Capital Ratio 2015 4384 3534 124x.

If increasing working capital compared to last years balance sheet then it seems an increase in its ability to pay its yearly dues compared to last years financial health. Changes in working capital is an idea that lives in the cash flow statement. The change in working capital formula is straightforward once you know your balance sheet.

The working capital ratio transforms the working capital calculation into a comparison between current assets and current liabilities. Another formula is Change in Current Assets of two periods Less Change in Current Liabilities of those two periods. Since the change in working capital is positive you add it back to Free Cash Flow.

How to interpret it and why it is important. What is Financial Modeling Financial modeling is performed in Excel to. There are two formulas that express change as a percentage one for an increase and one for a decrease both of which will result in a positive number.

18819105991263-13102 19192 34245. This measurement is important to management vendors and general creditors because it shows the firms short-term liquidity. Working Capital Current Assets Current Liabilities.

Finally the percentage change formula can be expressed as the change increase or decrease in value step 3 divided by its original value step 1 which is then multiplied by 100 as shown below. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Heres an example for Target.

This ratio is also known as Current Ratio Current Ratio The current ratio is a liquidity ratio that measures how efficiently a company can repay it short-term loans within a year. Therefore Microsofts TTM owner earnings come out to be. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling and managing cash flow.

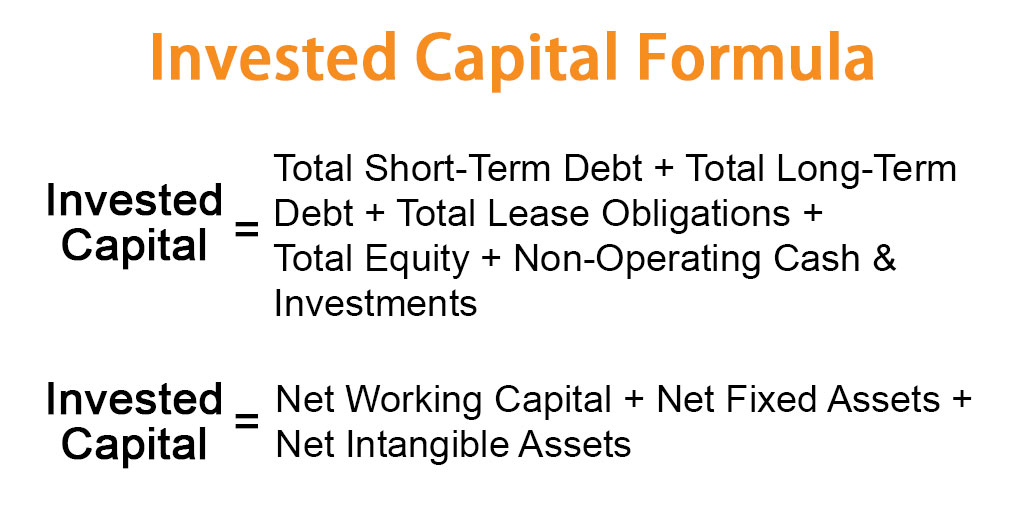

Increase decimal 100 This calculation is meant to represent a percentage decrease but if the percentage you get is negative that would mean that the percentage change is an increase. Remember that working capital current assets current liabilities. Net Working Capital Formula Working Capital Formula.

The working capital formula is. Changes in Working Capital Ratio. This will give you a decimal.

The sales for 2014 are 400. Change in Inventory 9497 8992 505. From the formula mentioned above you can calculate working capital.

Current ratio current assetscurrent liabilities read more. Changes in Working Capital measures the difference in a companys Net Operating Working Capital between two periods of time. Changes in the Net Working Capital How to Calculate.

Change in NWC Current year WC Last year WC. Change in Net Working Capital NWC Prior Period NWC Current Period NWC. You need to calculate WC for two different years and then minus them.

Net working capital is a liquidity calculation that measures a companys ability to pay off its current liabilities with current assets. The last step is to determine the change in working capital by using the formula. Finally the percentage change formula can be expressed as the change increase or decrease in value step 3 divided by its original value step 1 which is then multiplied by 100 as shown below.

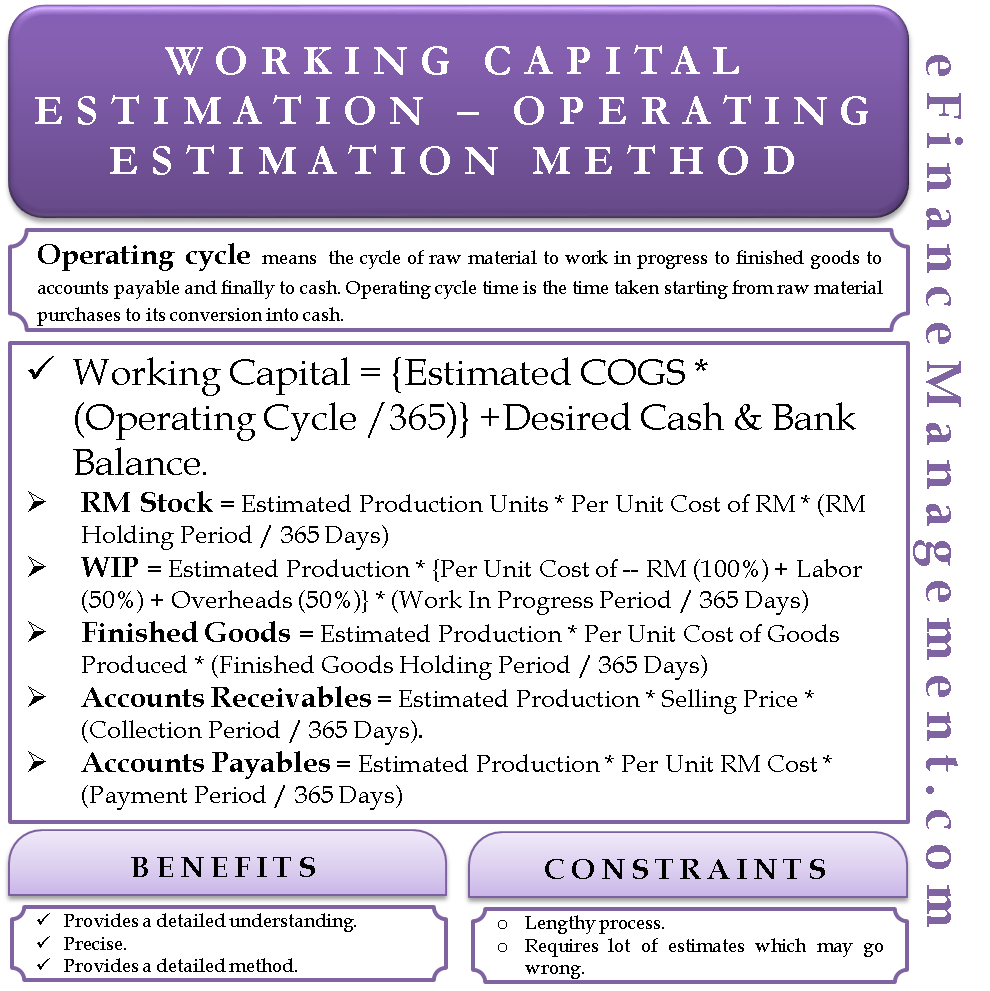

Difference between Working Capital and Changes in Working Capital. Calculation of the Sales to Working Capital Ratio. Percentage of Sales Method Formula Component of Working Capital 100 Sales of the Year.

Calculate working capital with marketxlsWhat does change in working capital means. Changes in Net Working Capital Formula Working Capital Current Year Working Capital Previous Year. So the change in NWC is 135000.

Calculate Changes in Net Working Capital using the formula below. Working capital is a balance sheet definition that only gives us a value at a certain point in time. Relevance and Uses of Percentage Change Formula.

Finally the Change in Working as calculated manually on the Balance Sheet will rarely if ever match the figure reported by the company on its Cash Flow Statement. The formula of Working CapitalWC Current AssetsCA - Current LiabilitiesCL both of same year The formula of Change in Working Capital Current Year WC - Previous year.

Change In Net Working Capital Nwc Formula And Calculator

Change In Working Capital Video Tutorial W Excel Download

Change In Working Capital Video Tutorial W Excel Download

Change In Working Capital Video Tutorial W Excel Download

Invested Capital Formula Calculator Examples With Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

What Is Net Working Capital How To Calculate Nwc Formula

Change In Working Capital Video Tutorial W Excel Download

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Why You Need To Know The Working Capital Formulation And Ratio India Dictionary

Net Working Capital Formula Calculator Excel Template

Changes In Net Working Capital All You Need To Know

Change In Net Working Capital Nwc Formula And Calculator

Cash Flow Formula How To Calculate Cash Flow With Examples

Working Capital Estimation Operating Cycle Method

Change In Net Working Capital Nwc Formula And Calculator